IN A NUT SHELL

We accept most PPO dental insurance plans as a non-participating provider. We will be more than happy to submit all insurance forms for you and help you recover the most from your benefits.

If you have further questions, please call our office and we'll be happy to help you understand your dental insurance benefits.

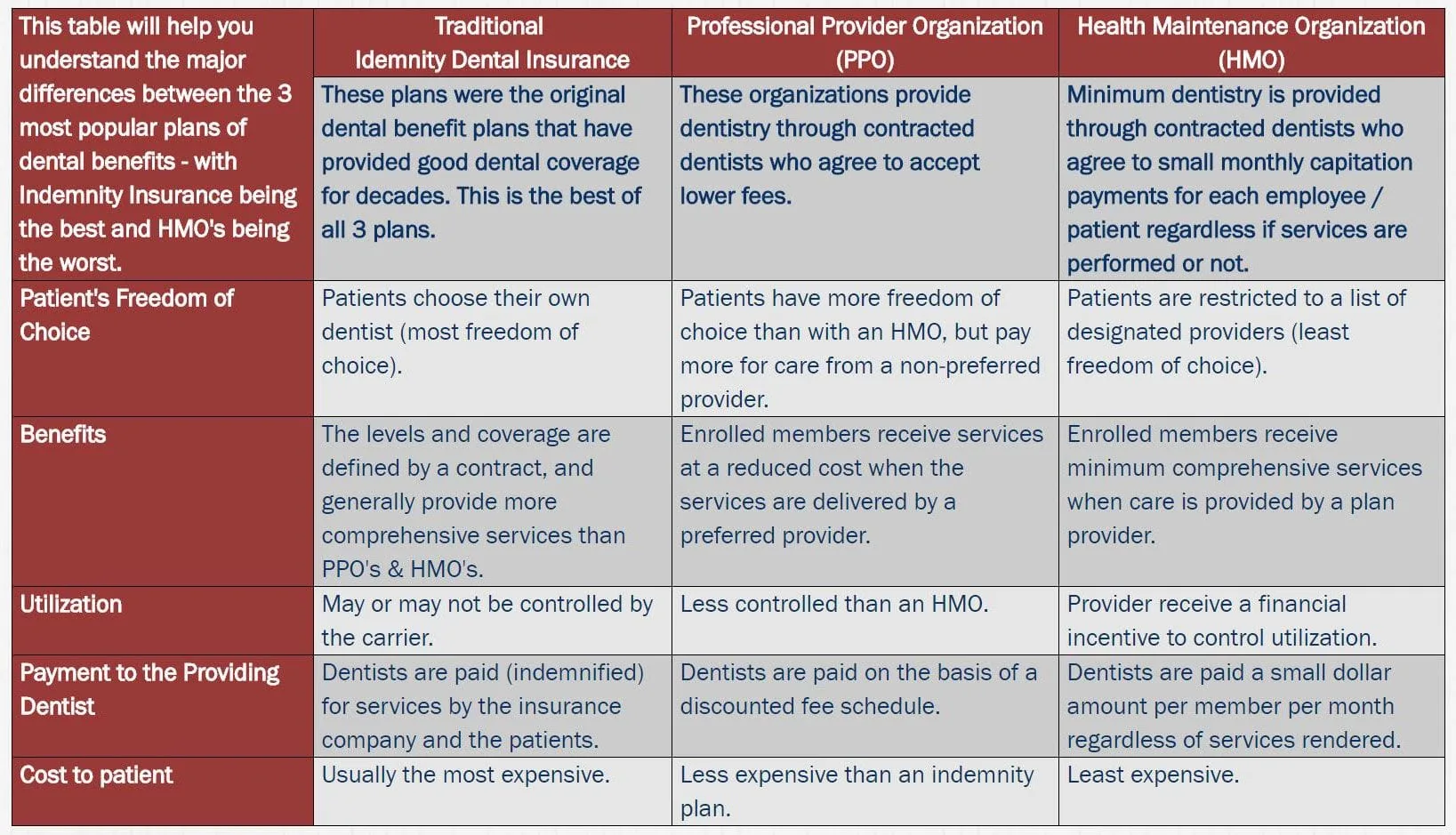

A GUIDE TO HELP YOU UNDERSTAND YOUR DENTAL INSURANCE OPTION

Dental insurance has benefited many patients and dental offices over the past 40 years. It has allowed thousands of people to take better care of their teeth and has brought many new patients into dental offices.

But now, we are seeing a significant increase in "managed health care" companies that decreases the patient's freedom of choice and many believe decreases the quality of care.

Your employer may present you with this option in order to reduce their benefit costs. You can use this information as a guide to help you understand and compare the various benefit plans.

THE FACTS

- Your insurance plan is a contract between your employer and the insurance company. All patients are financially responsible for their accounts. The insurance company is responsible to the patient. Specific question should be directed to your insurance carrier of your employer.

- No insurance plan covers all dental expenses. Some companies pay fixed allowances for certain procedures and others pay a percentage of the charge. It is the patient's responsibility to pay any deductible amount, co-insurance, or any other balance not paid for by their insurance company.

- Many routine dental services are not covered by insurance companies.

- The benefits the patients receives are determined by how much the employer pays for the plan. The less expensive the plan, the fewer the benefits.

- Insurance companies are in business to make money. They make more by paying fewer benefits. They also profit more by waiting to pay claims and by making dentists send in pre-estimates on the more expensive procedures. Delays in treatment results in less treatment.

- It has been the experience of many dentists that sometimes insurance companies tell their clients that certain dental fees are "above the usual and customary" or UCR, rather than tell them that the insurance benefits are too low. We know that some insurance companies do not upgrade fee schedules regularly, even with the cost of living index.

- In 1971, your dental insurance benefits for a year were approximately $1,000. Although your plan's premiums have greatly increased over the years, many plans still have the same maximum annual benefit. Adjusting for inflation, it should be around $4,500.

- Dentists who sign up to participate in managed health care plans agree to accept a significant decrease in their fees for the services they provide.

- With the increase of managed health care, the patients are losing their right to choose their own dentist. They are restricted to a list of dentists who agree to accept a lower fee.

- With the increase of managed health care, patients are losing their freedom to receive the dentistry of their choice based on the recommendations of the ADA and of their dentist.

- The trend with managed health care is that patients are losing more and more of their freedoms and coverage of quality dentistry, and the dentists receive less compensation for their services.

-

Many insurance companies accuse the dental profession of not controlling costs. Look at the facts:

- In efforts to keep dental health care cost down, dentists' incomes have not kept up with the cost of living in 22 out of the last 23 years.

- Insurance companies are constantly decreasing the availability of quality services to the patient.

- Insurance companies are recording record profits with bonuses to their individual CEO's ranging from $2.8-$15.5 million.

OPINIONS

The following are NOT FACTS based on any documented study. Although, they are the general opinions of most health care providers and many patients concerning Managed Health Care plans that are replacing many traditional plans.

- Dental offices are encouraged to do the least amount of dentistry as possible without concern for the patient's well being.

- Dental offices will be tempted to use inferior supplies and laboratories when treating discounted managed care patients.

- Many managed care patients may not receive the same quality treatment as traditional full fee-for-service patients.

- Many offices give preferential appointment times and courtesies to traditional full fees-for-service patients compared to their managed care patients.

- Many dentists prefer not to compromise their services, and therefore choose not to participate in these plans.